The Reserve Bank has recently removed LVR restrictions for 12 months, which they will review on 1 May 2021. LVR stands for loan to value ratio and it is the amount of lending you have secured against the value of your property. The old rules were forcing banks to require a 30% deposit for investment properties and 20% for owner-occupied properties (most of the time). The RBNZ introduced these LVR restrictions in October 2013 to support financial stability by reducing the risk of homeowners being forced to sell as the homeowners’ equity position would be stronger.

Banks have recently toughened their servicing criteria so this is not going to be a money giveaway and you will still have to meet tough criteria to qualify for higher lending amounts than you would have qualified for under the past regime.

What we predict.

The RBNZ was limiting what lending banks could offer via the LVR rules, but removing the rules does not force the banks to lend you money more easily. Now it is at the bank’s discretion as to how much deposit they require based on income, expenses, age and other factors like where the house is located and what type of dwelling it is. Each bank will have different requirements, so it’s really important you ensure you work with the bank best suited to your situation by using our free mortgage advisory service.

First Home Buyers – if you have income certainty, now might be a good time to be on the lookout for a bargain as people look to sell assets they might be forced to accept lower bids.

Investors – The implication is that you may be able to buy more properties. Banks are already starting to give us guidance about lending to 80% on investment properties (with some restrictions). If you were struggling with low equity but had good cashflow you are now in a better position to buy.

How should you respond today?

People fall into a trap of looking at their options once but forgetting the world is a dynamic place, your options today are different to last week. It’s time to “re-group” and look at your financial position. A mortgage adviser can help you identify strengths, weaknesses, opportunities and threats. They will also clarify if you have the ability to access extra funds in an emergency or grab opportunities if they present themselves.

Keep an eye on your borrowing power by using the mortgage snapshot. We will make updates to our formulas as the banks make firm announcements.

How could you be thinking about the future?

I asked Blandon Leung – senior adviser, at mortgagehq – for comment, Blandon says;

“We love leverage, but DO NOT over-leverage. Cash-flow is king! You have seen how quickly the world changes, and income or property price changes can cause devastating financial harm.

If you ask me, now is the best time to consider investing in properties [since the last boom]. Interest rates are at an all-time low of around 3%, meaning a $1 million interest-only loan will cost $587 per week. This means properties that were negative yield, are now positive cash flow, without their price changing.

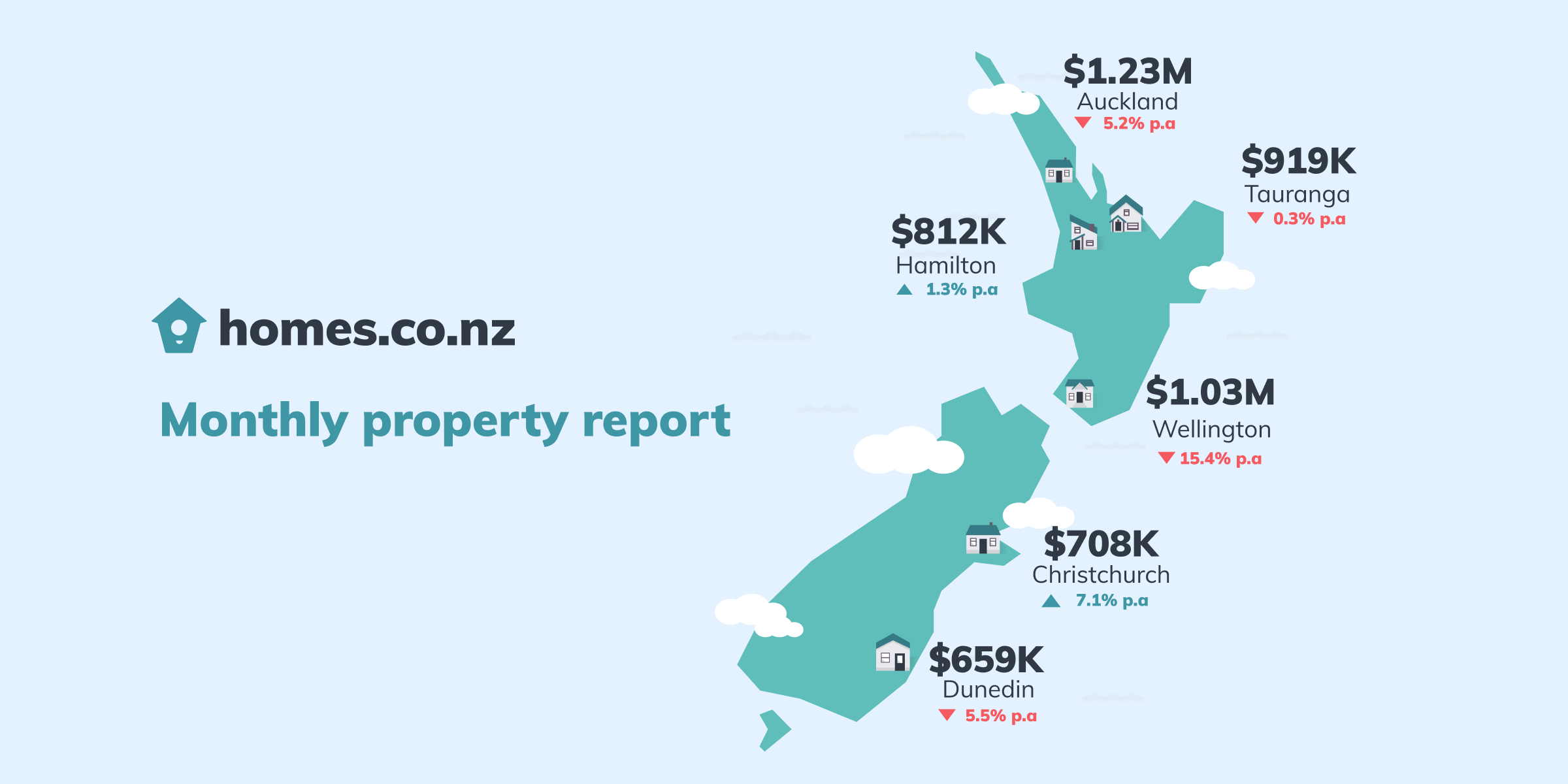

What property can you buy for $1 million that would give you less than $650 per week rent? (however, I would aim for much higher rent) If you believe in the long term capital gains for places like Auckland, Hamilton and Wellington, now might just be the best time to lock in a discount as other people are unfortunately forced to sell in a buyer’s market.

Building wealth and financial freedom through property investment for most people will take decades. Rushing it will often lead to costly mistakes. The downside for our future is we have the uncertainty of employment and the possibility of supply exceeding demand in the short term.

When doing your numbers on properties, be conservative on the expected rent, factor in higher vacancy rates and maintenance costs – if you still come up positive in the tens of thousands it might just be worthwhile for you to consider further.”