It’s good news for first home buyers with changes to the support offered by the Government. These changes took effect from 1 April 2021 to better help prospective first home buyers get on the property ladder.

The 2 main initiatives are:

- First Home Loans

- First Home Grants

The biggest leg up is via the Government’s First Home Loan scheme. First-time buyers with a yearly income less than $95,000 (or $150,000 for a couple) who are buying a property less than the regional price caps, and meet the lender’s lending criteria, will now be eligible to borrow with only a 5% deposit. This scheme includes a number of banks (such as Kiwibank, TSB and Westpac) and credit unions.

Over 80 towns around the country have a median sale price less than regional price caps (based upon sales within the last 6 months). With a potential deposit of “only” $26,500 needed for a new property in Christchurch, or less than $12,000 on the West Coast, a path to the property market is suddenly more accessible.

Potential home deposits under the Government’s First Home Loan scheme

The other leg-up is the First Home Grant scheme. First Home Buyers who have contributed to Kiwisaver regularly for 3-5 years may be eligible for a grant of $5,000 when buying an existing home, or $10,000 when purchasing a new home.

The best way to take advantage of the full $10,000 may be to buy a section and build, however to be eligible the total combined costs for the land purchase and the house construction must be within the relevant house price caps.

Median sale price of vacant sections in last 6 months

This is obviously easier said than done! In Auckland, for example, the median sale price of a section is $682,500, leaving only $17,500 to build. We expect that even in Westport with sections selling for a little over $100,000, it will be difficult to build for a combined cost of less than $500,000.*

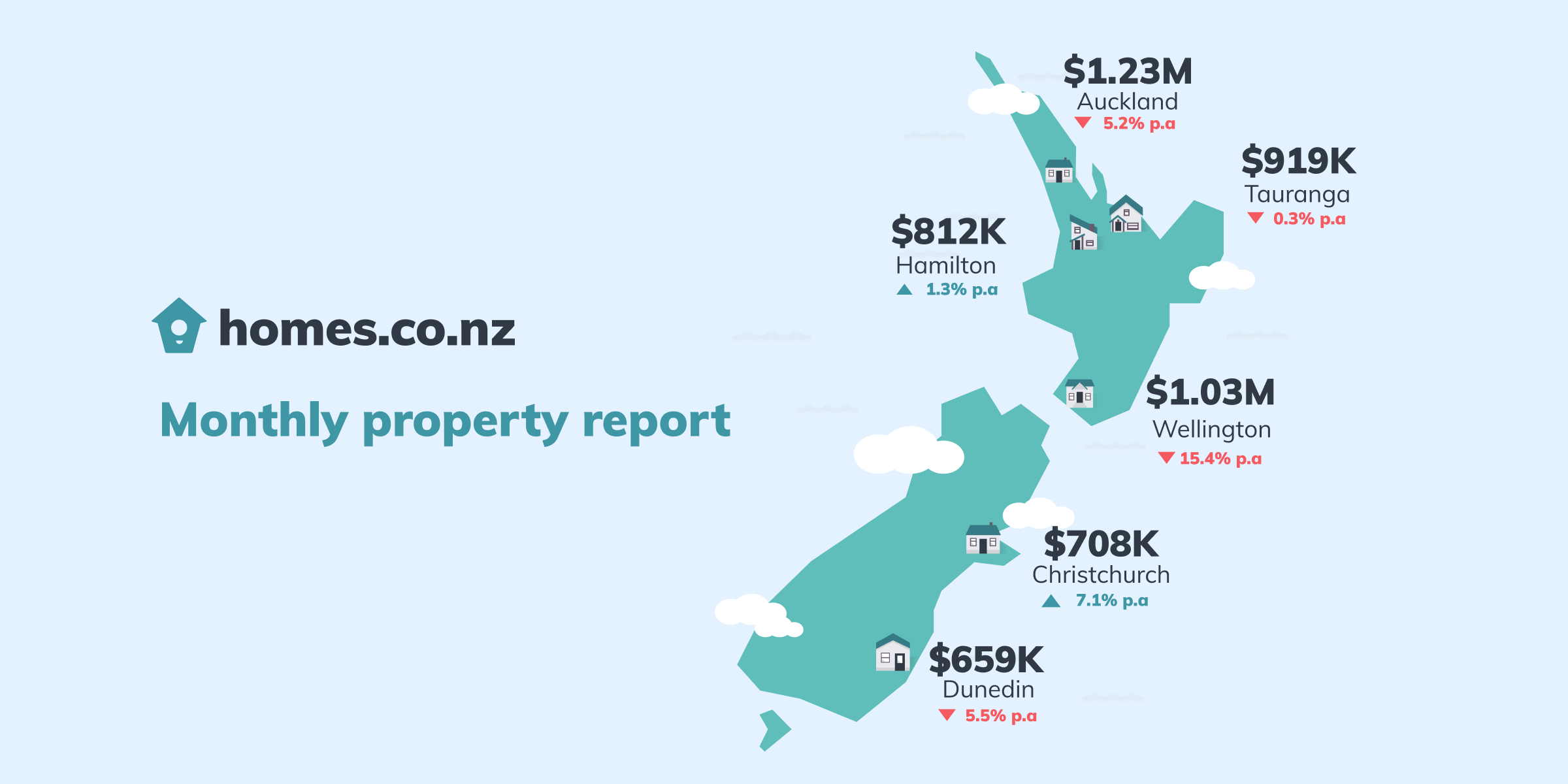

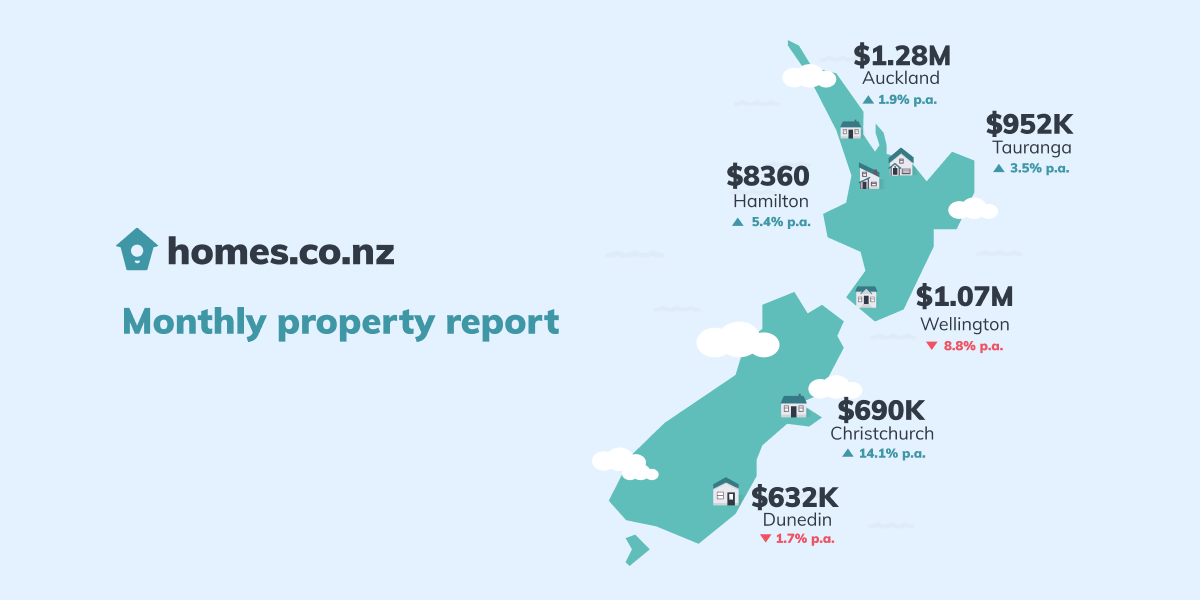

Monthly Property Update

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s May 2021 HomesEstimates, providing an up-to-date perspective on house values around New Zealand.

Trends in our Main Cities

The gap is closing! After Dunedin’s median HomesEstimate surpassed Christchurch in November 2019, the rate of growth in Christchurch is now more than Dunedin. The median HomesEstimate in the South Island’s biggest city is now $545k, up 20.6% p.a.

In other areas, it seems that over 20% growth per annum is the normal. The top performer continues to be Wellington where the Median HomesEstimate up 27.8% since this time last year to $1.05M. We expect the rate of growth to start slowing down as we head into Winter and the impact of new investor restrictions starts to take effect.

NZ’s First Home Buyer HomesEstimate

The “First Home Buyer HomesEstimate” is homes.co.nz’s estimate of what a typical first home may cost. It is calculated to be the lower quartile HomesEstimate in a town.

*Please refer to https://kaingaora.govt.nz/home-ownership/ for a more detailed description of Kainga Ora’s First Home Loan and First Home Grant schemes.

How do we calculate these figures?

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s monthly HomesEstimates and provides an up-to-date perspective on house values around New Zealand. By valuing the entire housing stock, the homes.co.nz Monthly Property Update can compare median values from month to month in a consistent and reliable way. Our HomesEstimates are calculated for almost every home in New Zealand by an algorithm that identifies the relationships between sales prices and the features of a property.

Established in 2013, homes.co.nz is NZ’s first free property information portal eager to share free property information to New Zealanders.