Last month, the team at homes.co.nz tried to put recent property price decreases into perspective by comparing any price drops to the average capital gains generated across the country.

Although most kiwi homeowners have owned their home for an extended period of time and are able to withstand price fluctuations, we do acknowledge that there are those who have purchased recently who may be worried.

This month we’ve looked at where there may be a higher number of new homeowners and what the localised price trends are.

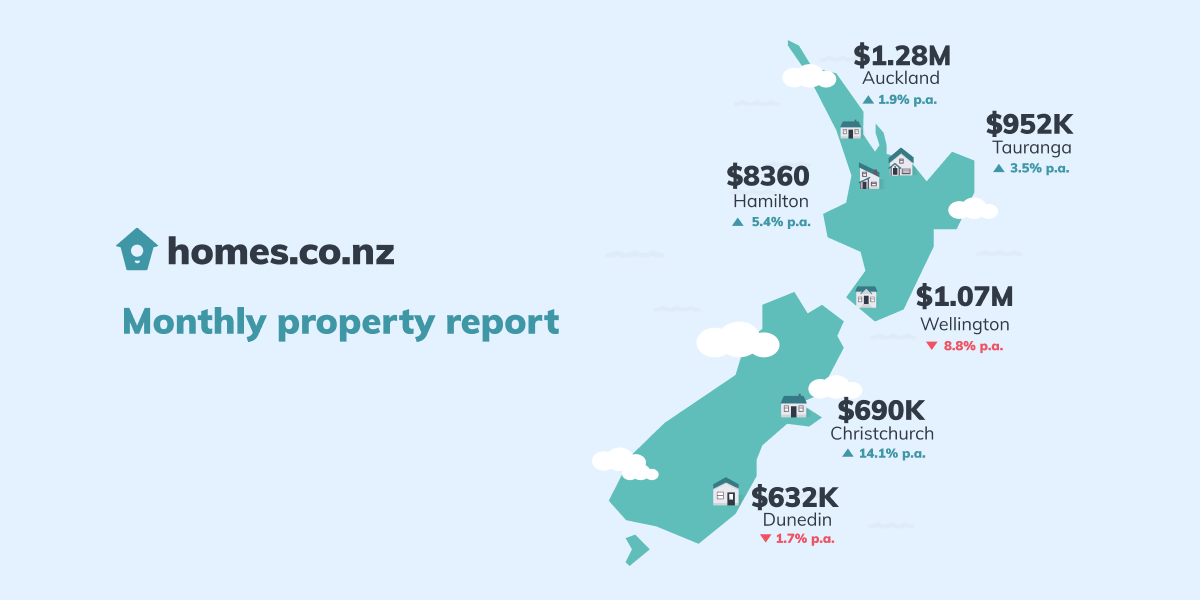

The largest price drops this year have been observed in the Wellington area with the Median HomesEstimate down ~10% from where it was at the beginning of the year. This has coincided with relatively less turnover with only 1.6% of homes selling this year. This trend is similar in Auckland and Dunedin where price decreases coincide with relatively fewer sales.

This contrasts with Tauranga and some more regional centres; such as New Plymouth, Invercargill and Whangarei, where house prices continue to increase and turnover is higher. Christchurch demonstrates a different dynamic again and remains the most tightly held market, despite prices continuing to increase (albeit much slower than they have).

If you are one of the 1-2% of homeowners who have purchased recently and are feeling concerned, then our advice is to not worry too much. Property prices change in cycles and it’s worth keeping a long-term view of your home’s value. The other dynamic is rising interest rates which may mean that your mortgage servicing costs are increasing while your asset’s value is decreasing. If this is the case, then make sure you talk to your bank or mortgage broker to consider your options.

Monthly Property Update

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s July 2022 HomesEstimates, providing an up-to-date perspective on house values around New Zealand.

Trends in our Main Cities

The median HomesEstimate continues to decrease in our main centres, but the trend does appear to be plateuing. The upside of decreasing house prices is that a first home may be more achievable for some. This month Homes.co.nz’s First Home Buyers HomesEstimate has now dipped below $1M in every main centre, with Auckland’s FHB HomesEstimate decreasing to $996K..

How do we calculate these figures?

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s monthly HomesEstimates and provides an up-to-date perspective on house values around New Zealand. By valuing the entire housing stock, the homes.co.nz Monthly Property Update can compare median values from month to month in a consistent and reliable way. Our HomesEstimates are calculated for almost every home in New Zealand by an algorithm that identifies the relationships between sales prices and the features of a property.

Established in 2013, homes.co.nz is NZ’s first free property information portal eager to share free property information to New Zealanders.

NZ’s First Home Buyer HomesEstimate

The “First Home Buyer HomesEstimate” is homes.co.nz’s estimate of what a typical first home may cost. It is calculated to be the lower quartile HomesEstimate in a town.