The property market is in a different phase to what many of us are used to with prices decreasing across much of the country.

Decreasing property values are eroding homeowners’ capital gains (although the capital gains for many are in excess of 100%) and this is evident in Wellington where the median HomesEstimate is down 1.2% p.a. Most kiwis have grown accustomed to double digit property price growth and prices that are less today than 12 months ago may be a shock.

But this may be a blessing for First Home Buyers. Decreasing property prices also mean a decrease in homes.co.nz’s First Home Buyer’s HomeEstimate. The “First Home Buyer HomesEstimate” is homes.co.nz’s estimate of what a typical first home may cost and is calculated to be the lower quartile HomesEstimate in a town.

The First Home Buyer HomesEstimate is now less than $1M in all of our main centres. At it’s peak in February, the FHB HomesEstimate was as high as $1.09M and $1.01M in Auckland and Wellington, respectively. These estimates have decreased by 10% in Auckland to $978K, and decreased by 13.8% in Wellington to $887K.

All other main centres have also seen the FHB HomesEstimate decrease from previous peaks. Since February, the FHB HomesEstimate has decreased by ~5% in Tauranga and Hamilton, 7.2% in Dunedin and even decreased by 1.2% in Christchurch where median values have continued to modestly increase. The latest FHB HomesEstimates around the country can be seen below.

First Home Buyers are facing enough headwinds with high interest rates, increasing costs of living and a high scrutiny on new lending. At least the property price breeze seems to be in their favour.

Monthly Property Update

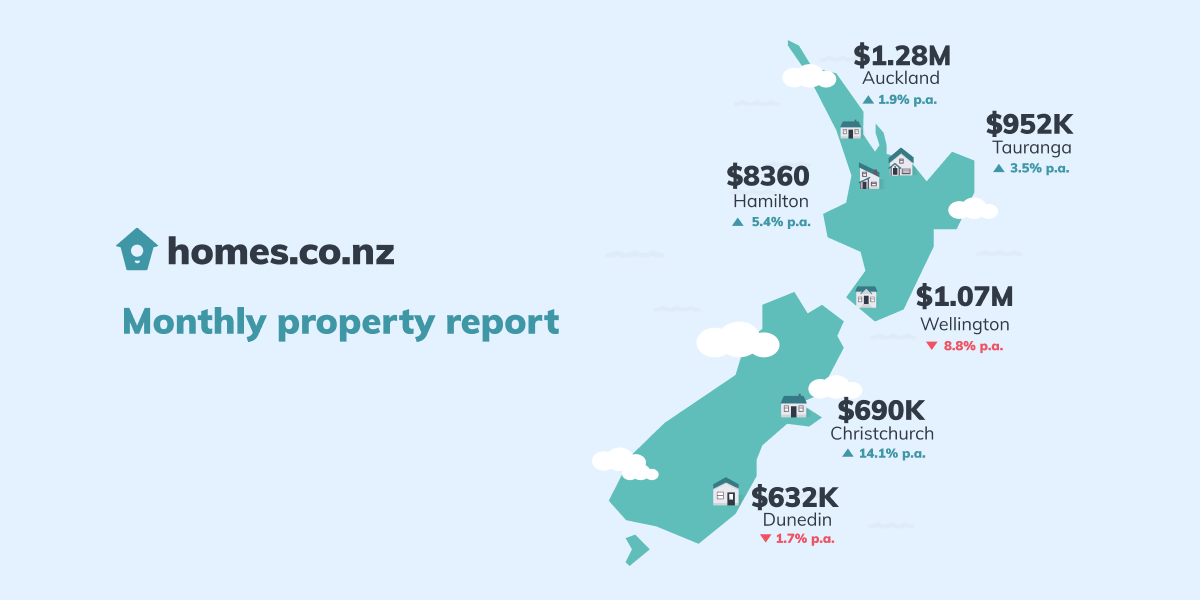

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s August 2022 HomesEstimates, providing an up-to-date perspective on house values around New Zealand.

Trends in our Main Cities

With the exception of Christchurch where the median HomesEstimate remained flat at $707K, the median HomesEstimate decreased in all other main centres this month. This is eroding the capital gains seen in the last year, with the median in Wellington even decreasing by 1.2% in the last 12 months to $1.13M (down from a peak of $1.31M in February).

How do we calculate these figures?

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s monthly HomesEstimates and provides an up-to-date perspective on house values around New Zealand. By valuing the entire housing stock, the homes.co.nz Monthly Property Update can compare median values from month to month in a consistent and reliable way. Our HomesEstimates are calculated for almost every home in New Zealand by an algorithm that identifies the relationships between sales prices and the features of a property.

Established in 2013, homes.co.nz is NZ’s first free property information portal eager to share free property information to New Zealanders.

NZ’s First Home Buyer HomesEstimate

The “First Home Buyer HomesEstimate” is homes.co.nz’s estimate of what a typical first home may cost. It is calculated to be the lower quartile HomesEstimate in a town.