There are signs that the market is finally slowing and many commentators are predicting that we may be approaching a turning point. Assuming we are approaching the end of the current property cycle, we thought we’d step back and provide some context for homeowners who may be worried about the value of their property taking a dip.

I’m sure all homeowners out there can remember how hard it was to get on the property ladder, but also how they’ve since been able to sit back and watch the value of their home go up and up. It may come as a surprise to many just how much wealth has been generated in this way.

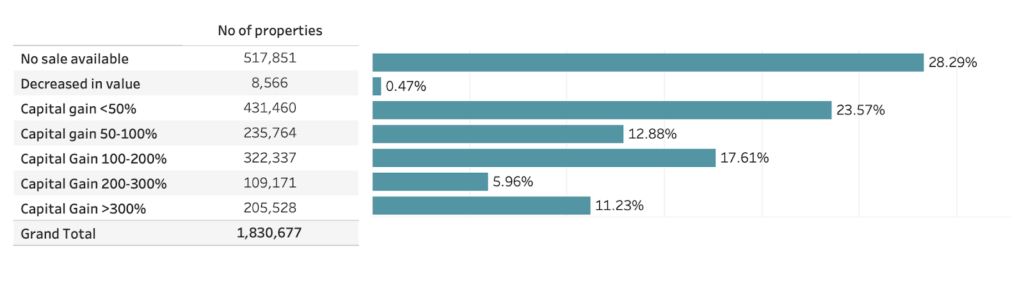

Over 47% of homes across New Zealand have seen the value increased more than 50% above the purchase price. Or even more staggering is that 1 in 3 properties have doubled in value since they were purchased and 1 in 10 properties (11%) have even tripled in value.

Capital growth across NZ housing stock

Capital growth across NZ housing stock

Brad Olsen, Principal Economist at Infometrics, says these capital gains are also contributing to stronger spending levels; “Rising house prices are certainly ensuring that households remain upbeat about the future, with their main asset having increased significantly in value. With a third of houses having doubled in value since they were bought, there’s a strong foundation to support household confidence which in turn is keeping spending levels high in the economy – a stronger economic position generally means stronger spending intentions”

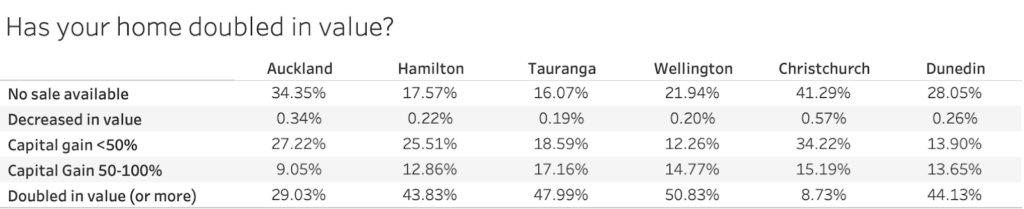

In some of our main centres, the trend is similar. After a period of sustained growth, more than half of Wellington properties have now doubled in value (and over 40% in Hamilton, Tauranga and Dunedin). Christchurch has seen less growth with only 8.7% of properties having doubled in value since they were purchased, which Brad says “highlights the less frenzied housing market in that region”.

Capital growth across NZ’s main centres

Capital growth across NZ’s main centres

One of the side effects of this growth (and wealth generation for existing homeowners) is that fewer properties are available for sale which adds further price pressures.

Brad Olsen explains “The high levels of capital gains for a large number of houses also helps explain why there are fewer houses on the market – usually, with these levels of capital gains, more people would sell and try to realise that gain (and turn it into cash). But with the bright line test extended to 5 years a few years back, these capital gains figures also highlight the large amounts of tax people stand to owe if they do sell within the bright line test timeframe – meaning people will likely want to sit on their investment until the bright line period has passed.”

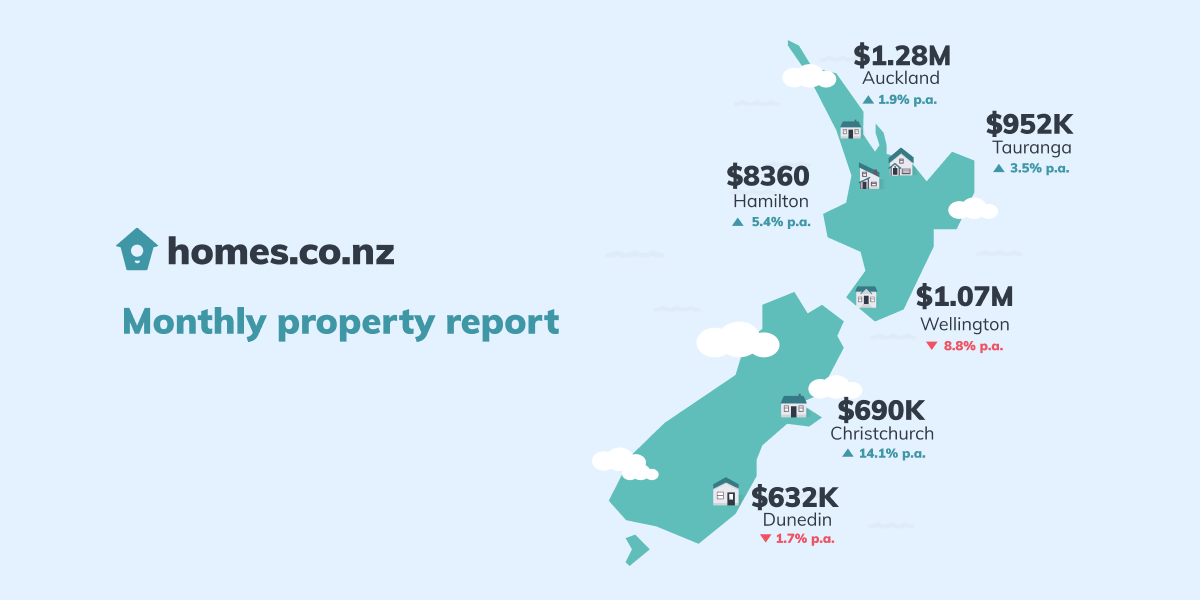

Monthly Property Update

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s August 2021 HomesEstimates, providing an up-to-date perspective on house values around New Zealand.

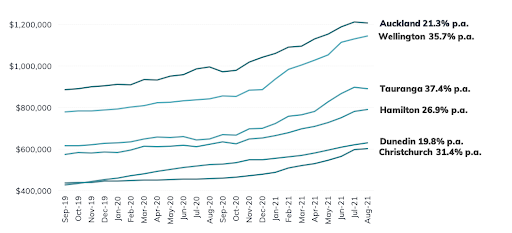

Trends in our Main Cities

Watch out Dunedin! The median HomesEstimate has surpassed $600k in Christchurch for the first time, up over 30% in the last 12 months. Meanwhile, despite there being signs of price growth slowing in other centres, we don’t expect any material price dips to happen anytime soon.

How do we calculate these figures?

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s monthly HomesEstimates and provides an up-to-date perspective on house values around New Zealand. By valuing the entire housing stock, the homes.co.nz Monthly Property Update can compare median values from month to month in a consistent and reliable way. Our HomesEstimates are calculated for almost every home in New Zealand by an algorithm that identifies the relationships between sales prices and the features of a property.

Established in 2013, homes.co.nz is NZ’s first free property information portal eager to share free property information to New Zealanders.

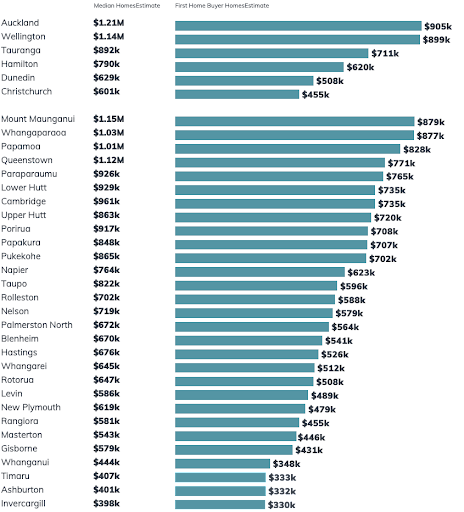

NZ’s First Home Buyer HomesEstimate

The “First Home Buyer HomesEstimate” is homes.co.nz’s estimate of what a typical first home may cost. It is calculated to be the lower quartile HomesEstimate in a town.