First home buyers needing to look south

March was a significant month for the property market, with the Government announcing their new housing policy. Here’s what you need to know:

- The bright-line test will be extended to 10 years for properties acquired on or after March 27

- Property investors will no longer have the ability to offset their interest expenses against their rental income when calculating their tax

- $3.8B fund to support infrastructure to accelerate housing supply

- The income and house price caps to access First Home grants and loans will be lifted

This is already causing ripples amongst property investors and the long term impact on the property market is unclear, but this month the homes.co.nz team have taken a look into the immediate impact for First Home Buyers.

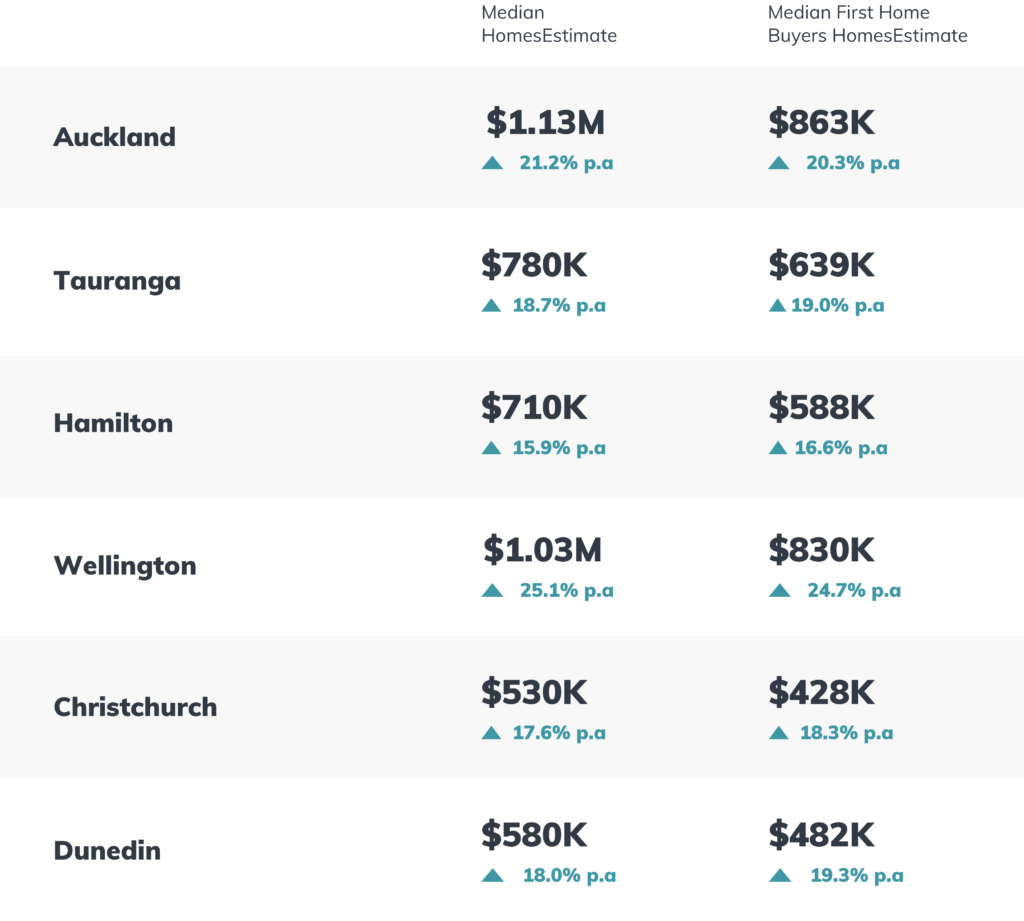

From April 1, accessibility to Kāinga Ora’s First Home grants have increased. Income thresholds will increase from $85k to $95k for single buyers, and from $130k to $150k for two or more buyers. House price caps have also increased by different amounts around the country, however increases in the caps have paled in comparison to the capital growth seen around the country in recent times.

Prospective first home buyers may feel that housing options meeting this criteria are few and far between, and they are not wrong. However there are always options out there, particularly on the city fringe or within the Apartment market.

The best news is for those in the south island. 31 suburbs in Christchurch have median HomesEstimates less than the city’s first home price cap for existing homes of $500k. There are also over 200 properties listed for sale (or 55%) on homes.co.nz in the city under these price capsAlthough only 2 suburbs in Dunedin (South Dunedin and Lookout Point) have median HomesEstimates less than $425K (price cap for existing homes), a further 22 suburbs have median values less than $550k, which is Dunedin’s first home price cap for new builds. 20% of Dunedin’s listing stock is also valued under the $425K price cap.

It’s a bit tougher in our North Island cities. Only 4 Auckland suburbs have a median HomesEstimate less than the new price caps. There are still inner city options for those willing to buy and Apartment in Auckland Central or Grafton, or properties further afield in Clendon Park and Manukau. Higher density suburbs in Wellington City, and Upper Hutt’s Timberlea and Maidstone also have affordable options, but even Lower Hutt’s most affordable suburb, Wainuiomata with a median HomesEstimate of $655k, is still priced out of reach.

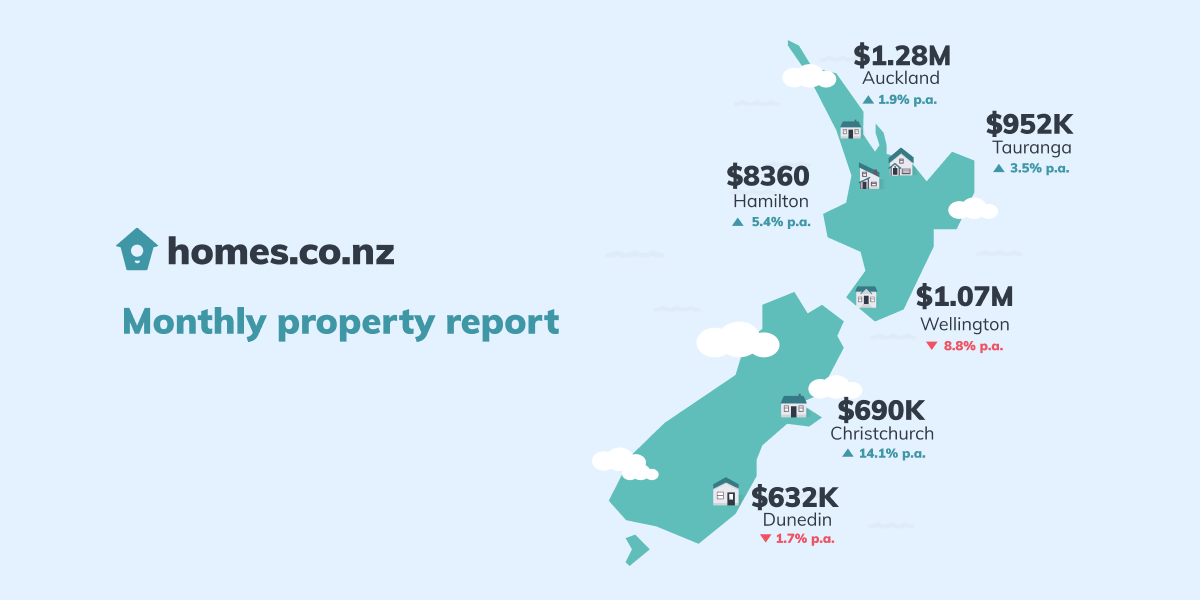

Monthly Property Update

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s April 2021 HomesEstimates, providing an up-to-date perspective on house values around New Zealand.

Trends in our Main Cities

There isn’t any noticeable slowing in house price growth off the back of the Government’s new housing policy but any impact is likely to take months (or years) to be seen. In the meantime, Wellington has consolidated itself as a million-dollar city, with the median HomesEstimate increasing to $1.03M.

The median HomesEstimate in Hamilton has now exceeded $700k for the first time ($710K, up 15.9% p.a.) and Tauranga now has a median homesEstimate of $780K (up 18.7% p.a.) and has $800k in its sights.

How do we calculate these figures?

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s monthly HomesEstimates and provides an up-to-date perspective on house values around New Zealand. By valuing the entire housing stock, the homes.co.nz Monthly Property Update can compare median values from month to month in a consistent and reliable way. Our HomesEstimates are calculated for almost every home in New Zealand by an algorithm that identifies the relationships between sales prices and the features of a property.

Established in 2013, homes.co.nz is NZ’s first free property information portal eager to share free property information to New Zealanders.