What is your favourite era of home?

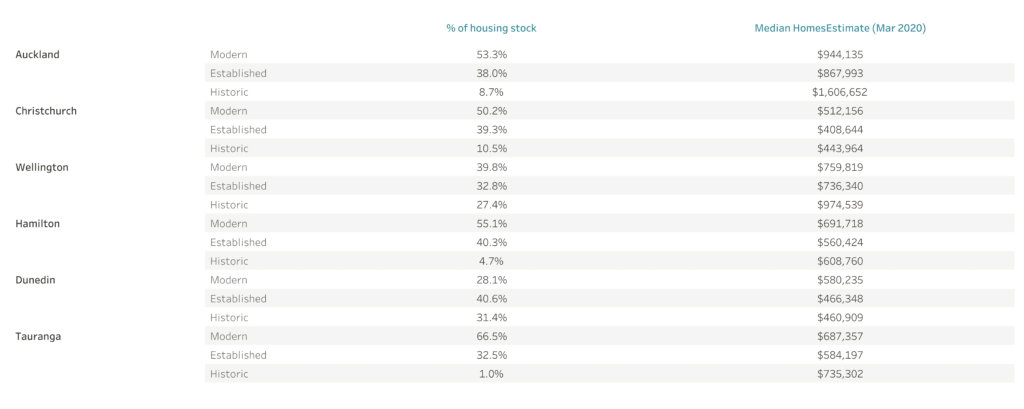

Do you dream of a character villa, or are you more interested in a new build? This month, the team at homes.co.nz have looked at property prices within different housing eras. We categorise different properties into the following house eras:

- Modern – Properties built since 1980

- Established – Built between 1940 and 1980

- Historic – Build pre-1940

In most areas around New Zealand, Modern homes demand a new home premium. For example, Modern homes in Christchurch have a median HomesEstimate of $512k, 15% and 25% premium above Historic and Established homes, respectively.

The opposite is true, however, in Auckland and Wellington where Historic properties demand the highest prices in each city. The median HomesEstimate for a Historic property in Auckland is over $1.6M which is 72% above the median HomesEstimate in the city. Similarly, the median HomesEstimate for a Historic property in Wellington is $975k, 21% over the city’s median.

Take a look at your town to see what you can expect to buy.

And what is the oldest city? Dunedin comes out on top with 31.4% of the housing stock being built pre-1940. The median HomesEstimate for these properties is $460k, compared to $580k for Modern properties in the city.

Check out one of the oldest properties that sold in Dunedin recently. Built-in the 1870s and purchased for $450k in November 2019.

Monthly HomesEstimate Property Update

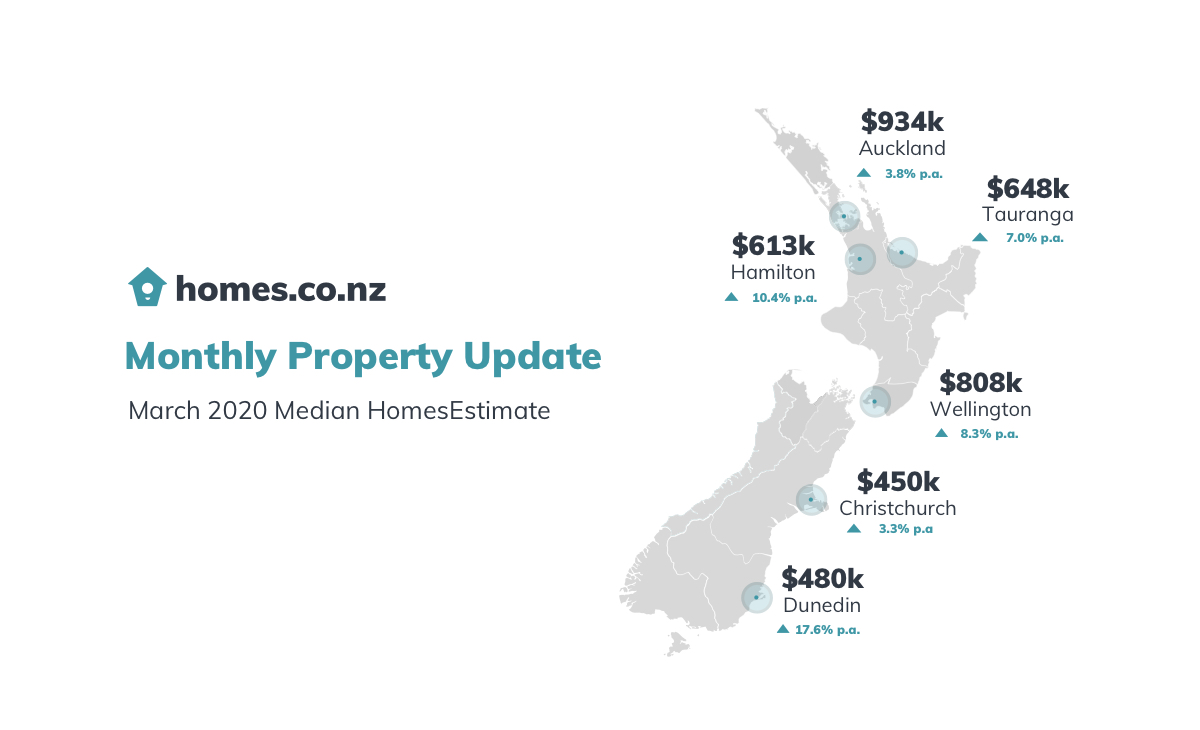

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s March 2020 HomesEstimates, providing an up-to-date perspective on house values around New Zealand.

Trends in our Main Cities

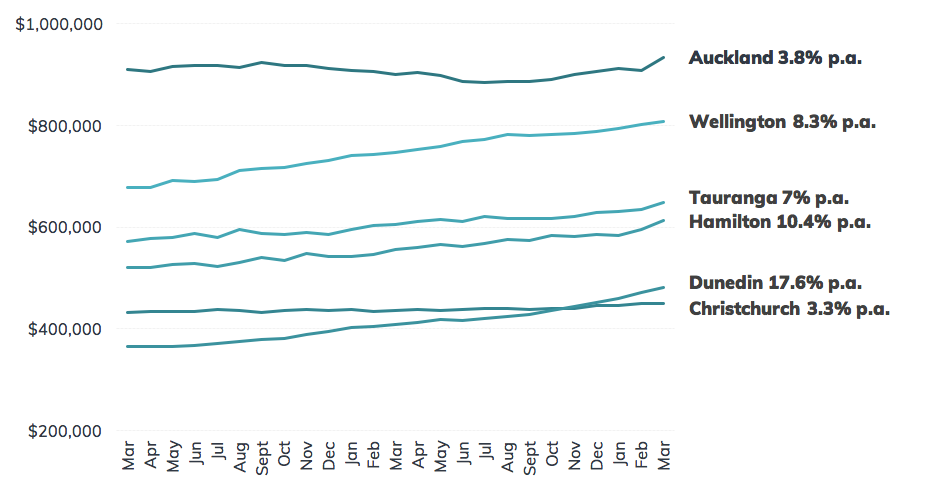

Strong sales results over the last 6 months are now flowing through to homes.co.nz’s HomesEstimates, with median figures increasing across the board.

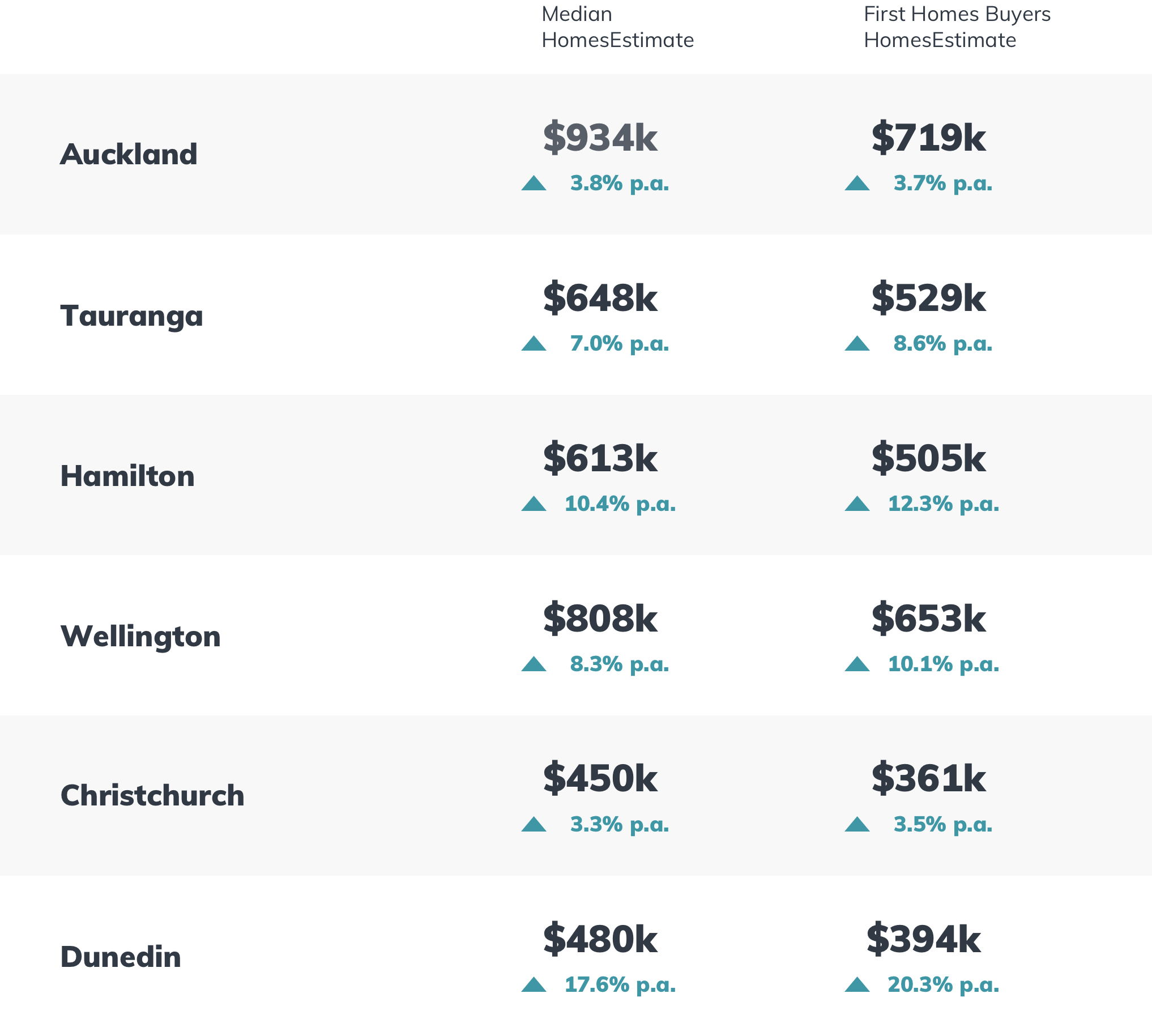

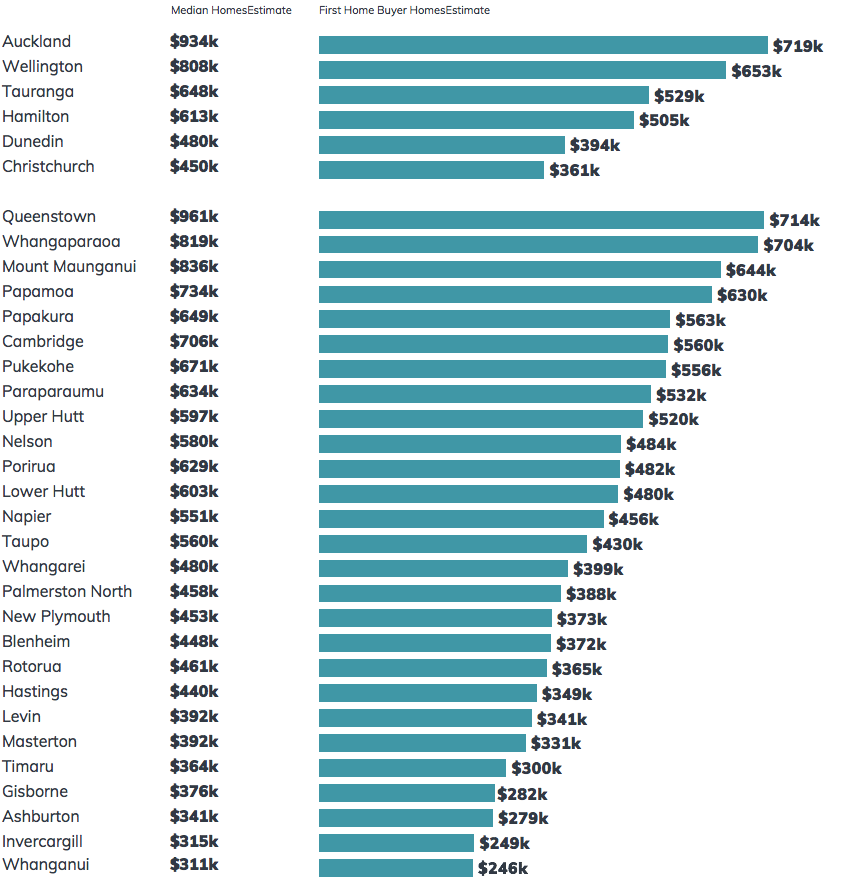

Significant increases were seen in the upper North Island with the median HomesEstimate up to $934k in Auckland (up 3.8% pa) and an increase of over 10% to $613k in Hamilton. The gap between Dunedin and Christchurch continues to grow with the median HomesEstimate in our southern cities being $480k and $450k, respectively.

NZ’s First Home Buyer HomesEstimate

The “First Home Buyer HomesEstimate” is homes.co.nz’s estimate of what a typical first home may cost. It is calculated to be the lower quartile HomesEstimate in a town.

How do we calculate these figures?

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s monthly HomesEstimates and provides an up-to-date perspective on house values around New Zealand. By valuing the entire housing stock, the homes.co.nz Monthly Property Update can compare median values from month to month in a consistent and reliable way. Our HomesEstimates are calculated for almost every home in New Zealand by an algorithm that identifies the relationships between sales prices and the features of a property.

Established in 2013, homes.co.nz is NZ’s first free property information portal eager to share free property information to New Zealanders.