How relevant is your Capital Valuation?

The Capital Valuation (or CV) for a property is a three-yearly assessment of a property’s value and is used by local councils to help determine the rates for properties in their area. The CVs are calculated using a computer algorithm and provide an estimate of the likely price a property would sell for at the time of the valuation.

This month homes.co.nz has looked at what properties have sold the most above and below their CVs.

Most under CV:

Most over CV:

There are many reasons why a property’s value can be different to its CV. Sales can be higher than capital values if a property is newly renovated or developed, and less when a property is left in a state of disrepair. It is also important to remember that capital value is only an estimate at a point of time and can quickly become out of date.

For a more accurate and up-to-date estimate of a property’s value, we suggest using homes.co.nz’s HomesEstimates. These are calculated each month using up-to-date sales information and track trends in your area.

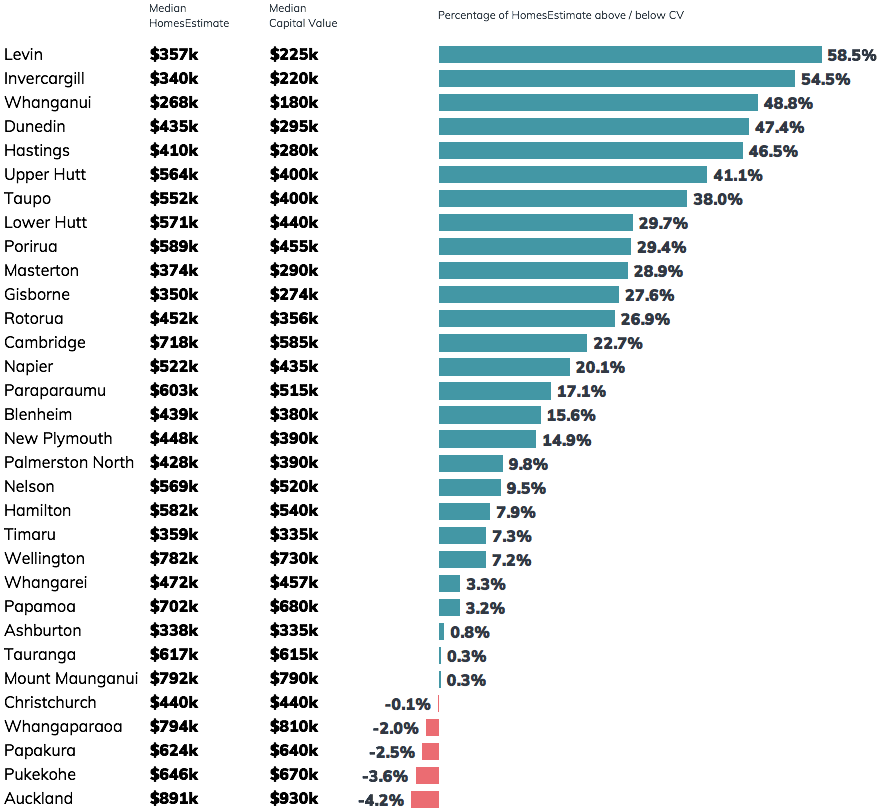

In the table below see how the median Capital Value compares to the median HomesEstimates in your suburb.

The graph below illustrates just how different the current market values are from CVs in some areas. The biggest difference is seen in Levin, where the median HomesEstimate is 59% over CVs that are now over 3 years old. Properties are sometimes valued less than the current CV too. This is what we are seeing in Auckland where the median HomesEstimate is now 4.2% below current CVs.

Monthly HomesEstimate Property Update

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s October 2019 HomesEstimates, providing an up-to-date perspective on house values around New Zealand.

Trends in our Main Cities

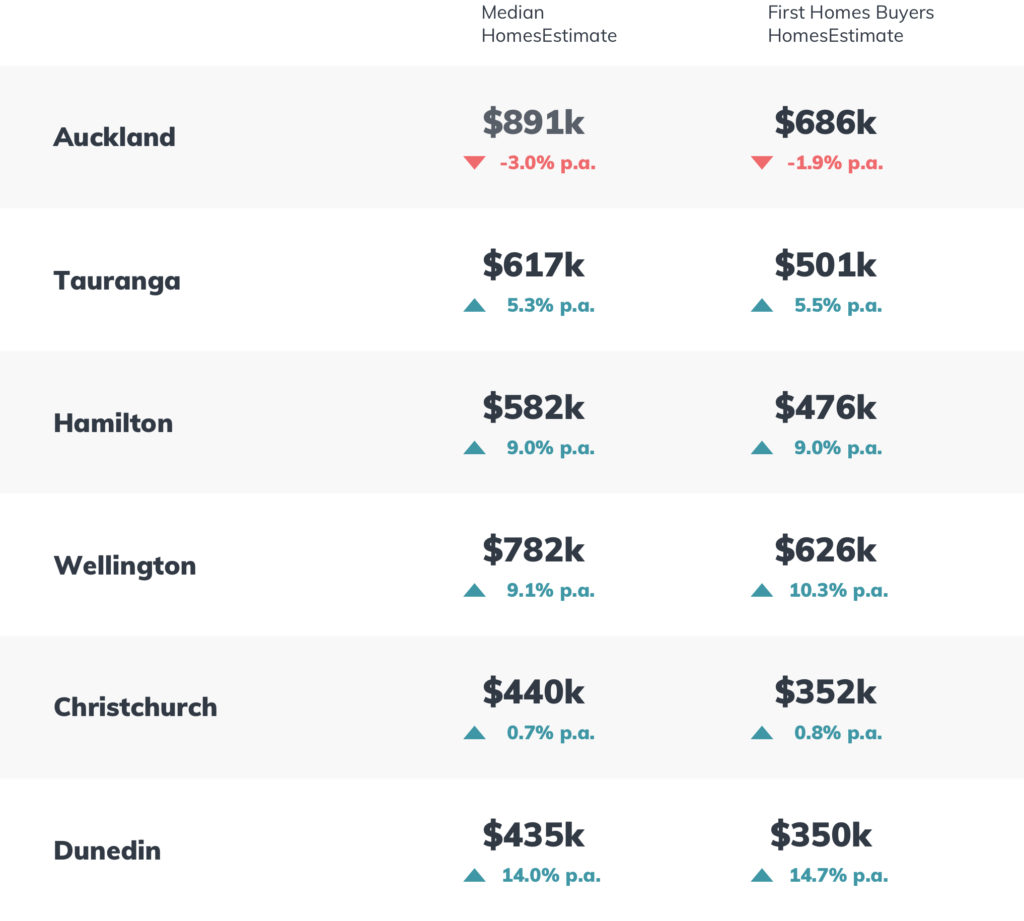

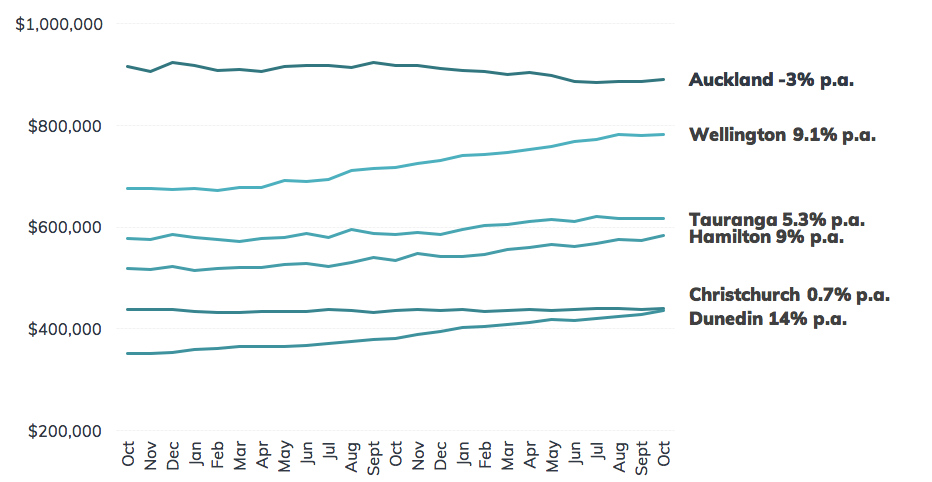

Watch out Christchurch, Dunedin has you in its sights! The median HomesEstimate in Dunedin continues to increase at 14% per annum and is now $435k, only slightly shy of Christchurch’s $440k.

In other areas; the median HomesEstimate has been steady in Wellington and Tauranga, but year-on-year growth remains strong at 9.1% and 5.3%, respectively. Strong growth has also been seen in Hamilton with the median HomesEstimate increasing by 9% per annum to $582k.

Auckland has increased slightly this month, but the longer term negative trend is clear to see with the Median HomesEstimate down 3% from this time last year.

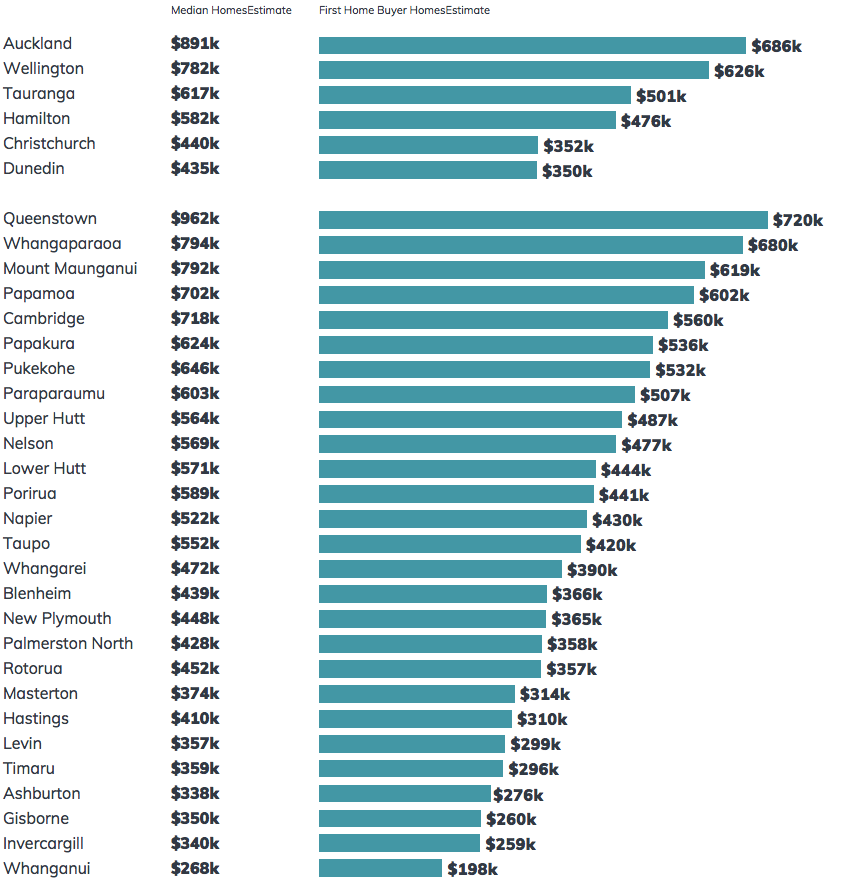

NZ’s First Home Buyer HomesEstimate

The “First Home Buyer HomesEstimate” is homes.co.nz’s estimate of what a typical first home may cost. It is calculated to be the lower quartile HomesEstimate in a town.

Established in 2013, homes.co.nz is NZ’s first free property information portal eager to share free property information to New Zealanders.

How do we calculate these figures?

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s monthly HomesEstimates and provides an up-to-date perspective on house values around New Zealand. By valuing the entire housing stock, the homes.co.nz Monthly Property Update can compare median values from month to month in a consistent and reliable way. Our HomesEstimates are calculated for almost every home in New Zealand by an algorithm that identifies the relationships between sales prices and the features of a property.

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s October 2019 HomesEstimates, providing an up-to-date perspective on house values around New Zealand.