2022 has seen a change in the New Zealand property market. Prices are softening across most of the country, sales volumes are decreasing and those properties that are on the market are taking longer to sell.

There are a number of underlying reasons for the changes (increasing interest rates being one) and this change has resulted in the expectations between buyers and sellers being misaligned; seller’s are still hoping for a top price that buyers are unwilling to pay.

Price decreases will certainly impact those who have purchased recently, but most homeowners will only be experiencing a decrease in the capital gains generated since they purchased. With the median length of ownership being close to 8 years, the capital growth for most homeowners far exceeds any recent decreases in prices.

To illustrate this, we’ve bench-marked quarterly sales figures against those seen 8 years ago. Despite the dips in the median sale prices in the first quarter of this year, a homeowner who purchased ~8 years ago in Auckland Wellington and Christchurch has still seen their homes’ values increase by ~100% (or doubled). For those in Dunedin, Hamilton and Tauranga price increases have been closer to 150%. This rate of growth is faster than the old adage of homes doubling in value every 10 years.

The rest of the country is somewhere in between, with median sale price in Q1 2022 being ~130% higher than 8 years ago.

We hope these insights put price changes into perspective and we urge homeowners and sellers to keep their capital growth in mind when forming their price expectations.

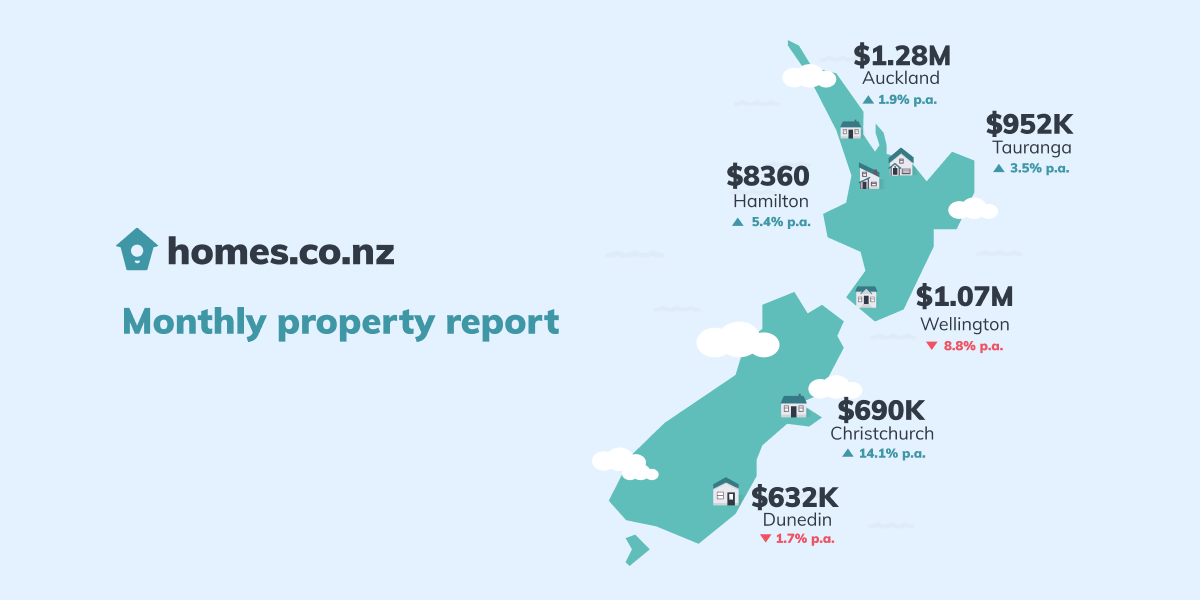

Monthly Property Update

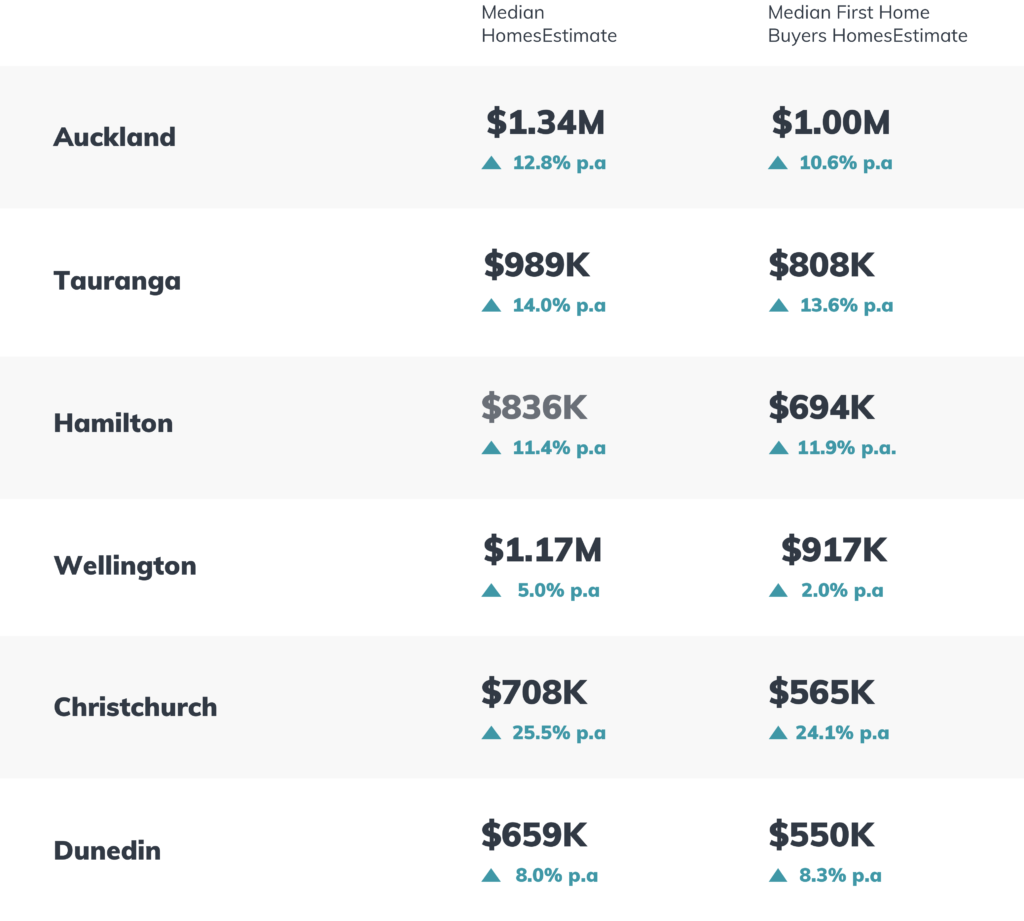

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s June 2022 HomesEstimates, providing an up-to-date perspective on house values around New Zealand.

Trends in our Main Cities

The median HomesEstimate in most of our main centres has decreased again this month as the soft sales prices of early 2022 are now impacting estimates. The exception is Christchurch where the median HomesEstimate has increased modestly to $708K.

How do we calculate these figures?

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s monthly HomesEstimates and provides an up-to-date perspective on house values around New Zealand. By valuing the entire housing stock, the homes.co.nz Monthly Property Update can compare median values from month to month in a consistent and reliable way. Our HomesEstimates are calculated for almost every home in New Zealand by an algorithm that identifies the relationships between sales prices and the features of a property.

Established in 2013, homes.co.nz is NZ’s first free property information portal eager to share free property information to New Zealanders.

NZ’s First Home Buyer HomesEstimate

The “First Home Buyer HomesEstimate” is homes.co.nz’s estimate of what a typical first home may cost. It is calculated to be the lower quartile HomesEstimate in a town.