The saying goes, if you want something done right, then do it yourself. However, when it comes to property, this may be easier said than done.

With prices for existing homes getting further and further out of reach, many potential buyers may consider building instead. This month the homes.co.nz team did an analysis on empty sections, their locations and what you can expect to pay for these.

It is no surprise that empty sections are rare in central Auckland. The median HomesEstimate for empty sections within 5km of the CBD is $1.75M, but these are few and far between within only 627 properties meeting this criteria (only 0.8% of the housing stock). This also highlights how most of Auckland’s property prices are tied up in the land, with the land value. As an example, one section in Remuera sold for $4M in November of last year.

The good news for those willing to commute are that land prices do get cheaper as you move further from the CBD. The median HomesEstimate of vacant sections between 5-10km from the CBD is $951k, which decreases to $708k for vacant sections 10-15km away (including western suburbs such as Massey, Henderson and Titirangi and southern suburbs such as Mangere and Pakaranga). As Aucklanders move further out the price increases again as section sizes start to increase on the city’s fringe.

In Wellington and Christchurch, the median HomesEstimate of vacant sections remains relatively consistent as you move further from the CBD. Although the prices remain consistent, the price per m2 does decrease as the typical section sizes increase.

Within 5km of the Wellington’s CBD the median price for a section is $474k for a median size of 503m2, and increases to $500k for a 647m2 for properties 5-10km away.

The price of land in Christchurch is more affordable with empty sections typically costing less than $320k. For those willing to get in the car, this money can stretch a long way with sections 10-15km away having a median size of over 1000m2.

Of course, buying land is only the start. Assuming you can find a builder, the costs to build are skyrocketing with reports of the cost of building being the highest in 2 years. There is help with some new lending options and grants directed to those building new, but is this enough?

Monthly Property Update

June 2021

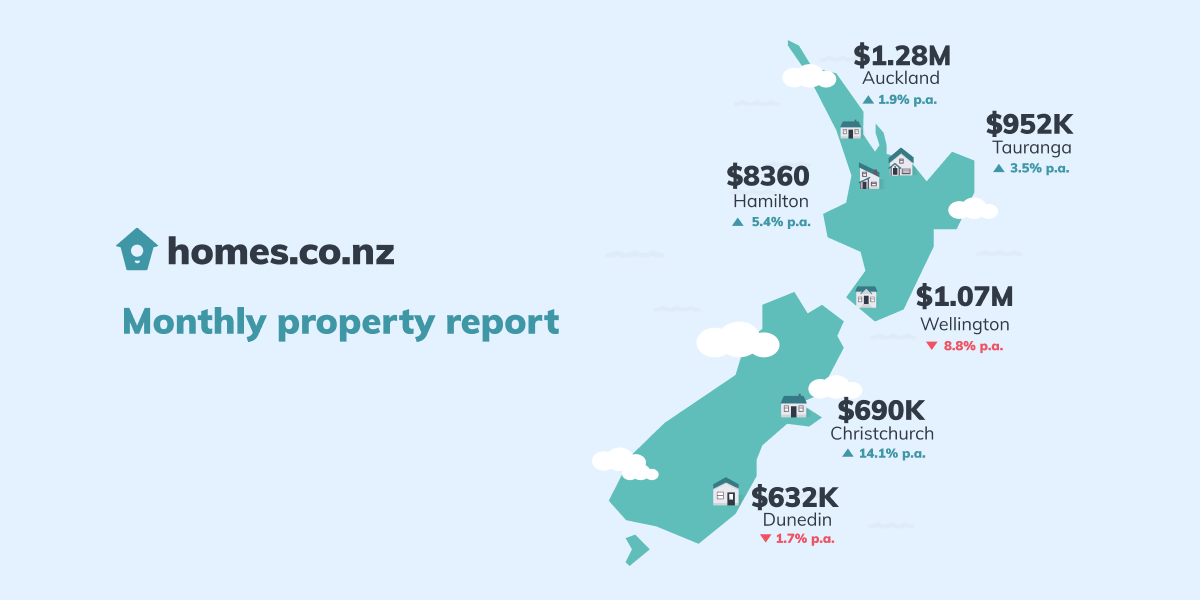

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s June 2021 HomesEstimates, providing an up-to-date perspective on house values around New Zealand.

Trends in our Main Cities

The median HomesEstimate in Wellington and Tauranga have both increased by over 30% in the last 12 months to $1.11M and $868K, respectively. Growth exceeding 20% was also seen in Auckland, Hamilton and Auckland. Although there are no signs of the property market slowing down yet, it’s important to bear in mind most sales records on homes.co.nz are provided by local councils following a 2-3 month delay. We’ll continue to watch this space for impacts of sales following March’s policy updates and we expect growth to start slowing throughout the rest of the year.

How do we calculate these figures?

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s monthly HomesEstimates and provides an up-to-date perspective on house values around New Zealand. By valuing the entire housing stock, the homes.co.nz Monthly Property Update can compare median values from month to month in a consistent and reliable way. Our HomesEstimates are calculated for almost every home in New Zealand by an algorithm that identifies the relationships between sales prices and the features of a property.

Established in 2013, homes.co.nz is NZ’s first free property information portal eager to share free property information to New Zealanders.

NZ’s First Home Buyer HomesEstimate

The “First Home Buyer HomesEstimate” is homes.co.nz’s estimate of what a typical first home may cost. It is calculated to be the lower quartile HomesEstimate in a town.